Tax Solution Integrates Dynamsoft's Web Document Scan SDK in its VAT-Refund Application

INDUSTRY:

Finance

QUOTE

Our main goal in processing of excise duty and VAT refund applications was to make the process of document management easier, faster and secure for us and our clients. Thanks to Dynamsoft's SDK, we optimized that process." Rafał Sumiński, Owner, Tax Solution

QUICK SUMMARY

Tax Solution, based in Rybnik is a small business focused on providing services related to VAT and Excise refunds within the EU. To speed up concluding VAT-refund requests, Tax Solution had built its own web application, which had a core need to make the processing of documents easier, faster and secure. Tax Solution knew from the start it would be better for them to use a well-developed, tested solutions and libraries for the scanning component. Fortunately, a friend referred Tax Solution to Dynamsoft, a vendor of the document scanning SDK they needed. Dynamsoft's Dynamic Web TWAIN SDK has a lot of features and Tax Solution leaned on the company to ensure expectations for its implementation and use were met. The Tax Solution web application for processing VAT refunds went through beta testing, which was successfully completed in Q1 2018. Now fully deployed, it is essential for processing VAT refunds across the EU. The scan component at the core of the application helps ensure efficient document capture and management for a streamlined workflow.

THE ORGANIZATION

Tax Solution, based in Rybnik is a small business focused on providing services related to VAT and Excise refunds within the EU. The company had built its own software for internal use to process VAT refunds throughout every country in European Union (EU). Tax Solution's application regularly concludes VAT refunds for several hundred clients in the transport, production and services industries. This includes processing paperwork, such as applications, invoice and receipts. To this end, Tax Solution employees are people knowledgeable in EU law, tax, and excise tax refund applications for EU countries. More information about the company is available at

http://www.tax-solution.eu.

THE TECHNOLOGY NEED

To speed up drawing up VAT-refund claims, Tax Solution's web application had a core need to make the processing of documents easier, faster and secure. They wanted a digital solution to avoid the common pain-points of dealing with paperwork. This includes filing and sorting receipts, invoices and applications that also need to be archived. Digitizing paperwork by scanning documents would streamline this workflow end-to-end. The staff will regularly scan documents to convert from paper versions to electronic versions. So, Tax Solution needs to have a reliable scanning and document imaging component for the application. To accomplish this, two software designers became involved in the design of the application.

Tax Solution knew from the start it would be better for them to use a well-developed, tested solution and libraries for the scanning component. It's well understood that coding a scan component from scratch can take months of extra work, an understanding of related industry standards, and a lot more money.

IMPLEMENTATION

For the entire application, from the point of initial planning to entering beta, has taken approximately two years. Thus, using a document scan SDK to eliminate extra development time became essential. The SDK would also let the developer team stay focused on their core expertise in VAT-related feature build-outs. Fortunately, a friend referred Tax Solution to Dynamsoft, a vendor of the document scanning SDK they needed.

A key feature would be to ensure capturing images from a scanner via a web browser, which the SDK provides. The application is integrated with a MySQL database. It uses many outside integrations too, such as with online banking systems or a component used to fill out PDF forms. Other technology integrations include the obvious: PHP, HTML, CSS, and JS.

There are approximately 10 planned users (Tax Solution employees) for the application and it will be used daily. Now fully streamlined, a user goes to the website and chooses the "add documents" option and then "from a file" or "scan" to capture a document. After selecting the scanner or file location, the file can then be saved on a server or database for processing of the related VAT refund and archiving as needed.

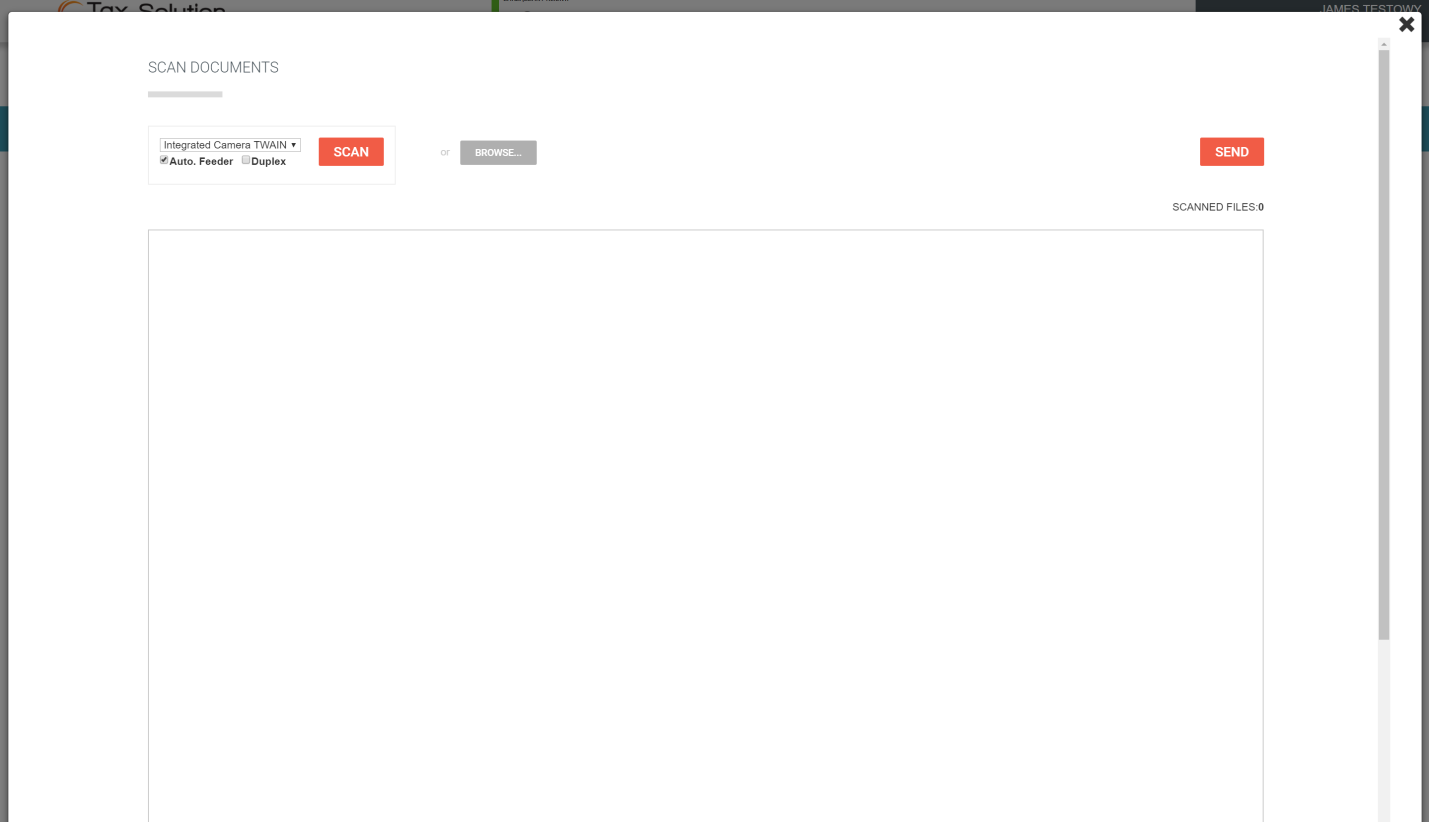

Shown: a Beta Version of the Tax Solution Application's Document Capture Page

Dynamsoft's Dynamic Web TWAIN SDK has a lot of features and Tax Solution leaned on the company to ensure expectations for its implementation and use were met. In the end, Dynamsoft's knowledge, work, and testing helped ensure a failure-free component.

About Dynamic Web TWAIN

Dynamic Web TWAIN provides developers with tools to create immediate cross-browser and cross-platform document scanning capabilities. Users can scan receipts, invoice and other documents from TWAIN, SANE, and ICA-compatible scanners using a variety of browsers - Chrome, Firefox, Edge, Internet Explorer (IE), Safari, and others – across Windows, macOS, Linux, iOS and Android operating systems. Images can be saved in various file formats – JPEG, TIFF, PDF, and more – or transferred and stored across varying protocols, local or remote file systems, database and document repositories.

REALIZED ADVANTAGES

Dynamic Web TWAIN provides programmers with simple built-in interfaces to access local imaging devices from web pages. They need only write a handful of lines of JavaScript code to enable cross-browser document scanning, uploading, and processing. It saves on costs by eliminating months of work coding from scratch to create comprehensive scanning and image capture functions. Development teams also realize long-term time and cost savings with better application robustness and faster time to market.

The Tax Solution web application for processing VAT refunds went through beta testing, which is expected to be successfully completed in Q2 2018. Once fully deployed, it will be essential for processing VAT refunds for hundreds of Tax Solution partners across the EU. The scan component at the core will help ensure efficient document capture and management for a streamlined workflow.