Customer Stories

Accelerating ID Verification for First United Bank

Snapshot

First United Bank, one of the largest banking organizations in the Southwest US, needed to streamline the ID capture process for new customers. It needed to accommodate multiple forms of ID and minimize time spent on manual form filling. Using Dynamsoft SDKs, the account opening process has been cut from 45 minutes to 10, leaving more time for relationship bankers to focus on guiding customers’ financial decisions.

Introduction

As a family bank that has grown rapidly into a ‘super community bank’ with 77 banking locations across Oklahoma and Texas, First United Bank retains its commitment to family values and community impact. First United’s purpose is to help customers “Spend Life Wisely” – achieving balance across their lives through wise financial decisions. Tellers are known as ‘relationship bankers’, who build a relationship with clients and learn about their financial journeys to guide their financial decision making.

Challenge

For First United, technology was getting in the way of their vital first conversations with customers. The account opening process was taking 45 minutes, with relationship bankers having to leave customers and walk to another room to scan IDs. They were then distracted with cutting and pasting customer details between 6 or 7 separate applications. It required a lot of patience from the customer and left very little time for dialogue.

The Enlight project goal was to reduce the time needed to validate IDs and prioritize the customer conversation, while achieving rigorous security requirements. The objective was to enable fast easy scanning at the teller workstation and extract personal data using barcode reading and OCR to pre-populate account opening forms.

Using Dynamsoft to automate ID capture we’ve cut account opening down from 45 minutes to 10 minutes and can spend more time understanding their financial goals."

– Tom Grindup, VP Architecture Lead, First United Bank

Solution

First United had always used third-party software developer shops for projects in the past but were gradually moving to in-house development. Making their developers more efficient was a high priority.

Our decision was all about making our developers more efficient. Our developers saw immediate success with Dynamsoft SDKs so it was a very easy choice."

– Tom Grindup, VP Architecture Lead, First United Bank

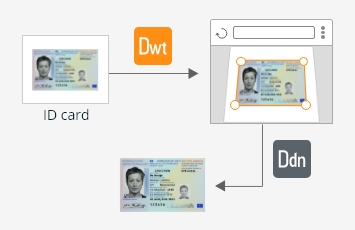

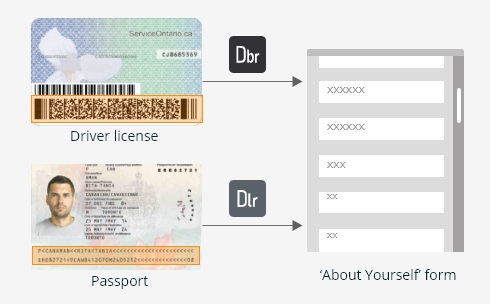

Customers opening a new account may present various forms of ID, from a driver’s license or state-issued ID to a passport, some of which have a barcode on the reverse. To accommodate all of these various forms of identification, First United chose to use a selection of Dynamsoft SDKs. Firstly, the ID is scanned through a web browser using Dynamic Web TWAIN. Document borders are cropped automatically using Dynamsoft Document Normalizer to eliminate user steps and save time.

ID is scanned through a web browser

If the customer presents a newer ID with a barcode, it is read using Dynamsoft Barcode Reader and the 'About Yourself' form fields are automatically filled in. If they have a passport, then Dynamsoft Label Recognizer will locate the MRZ code and apply advanced OCR to extract the data and fill out as much as possible, freeing tellers from tedious manual entry.

With security a top priority, First United uses third-party ID verification software from FIS to carry out a 3-point check: confirm the validity of the ID, verify personal details such as address and check watch lists for bad actors in the financial community.

Impact

The Enlight project will be rolled out to 350 relationship bankers across 108 branches in Oklahoma and Texas. The customer activation process has now been cut from 45 minutes to just 10-12 minutes, meaning that relationship bankers have more time to engage with customers, fully understand their financial goals and introduce other relevant products.

It is estimated that the project will save 3.5 years of person time just in new account openings. The real value of Enlight is not only accelerating customer activations but also increasing customer retention and opportunities for cross-selling.

Future plans include extending these efficiencies to customer account maintenance to accelerate the process of updating addresses or marital status. Mobile ID capture may also be a priority for business customers who need to do identity verification of new staff at hiring fairs.

Using Dynamsoft SDKs has saved us so much time. Automating the ID card capture process will save us 3.5 years of bank teller time – just on account openings."

– Tom Grindup, VP Architecture Lead, First United Bank

About Dynamsoft Barcode Reader

Dynamsoft Barcode Reader is a state-of-the-art barcode scanning software developer kit (SDK) that provides exceptional accuracy, even with challenging barcodes. Using advanced algorithms, it can read damaged, distorted, or poorly barcodes reliably at industry leading speeds, reducing the need for manual data entry and minimizing errors. Dynamsoft Barcode Reader is designed to integrate seamlessly with existing systems, making it easy to deploy and use in various industries, including retail, logistics, healthcare, and manufacturing.