Advanced Digital KYC Verification for Streamlining Banking KYC Processes

Today, Know Your Customer (KYC) is widely recognized as a critical tool in the battle against money laundering and financial crime, with customer identification being the essential component of the process.

The stakes are incredibly high for financial institutions in light of the current global anti-money laundering (AML) and combating the financing of terrorism (CFT) scenario.

What is KYC and its Importance in Banking?

KYC or Know Your Customer verification is the required procedure of identifying and confirming the client’s identity at account establishment and frequently thereafter.

In conclusion, banks must validate that their clients are the people they claim to be. A bank may refuse to open an account for a customer who does not fulfill the essential KYC requirements or suspend the business relationship.

When it comes to eKYC, or Electronic Know Your Customer, it is a procedure used in which the identity and address of the customer are electronically verified. For example, Aadhaar, a national biometric eID program in India, which is used for authentication of KYC documents electronically.

eKYC also includes collecting digital data from government-issued smart IDs (with a chip) that have a physical presence, as well as using verified digital identities and face recognition for online proof of identity.

The onboarding of customers can then be done through mobile. Not to mention, using artificial intelligence further helps enhance the accuracy of eKYC.

How Does KYC Document Verification Help Banking Organizations?

Bank-defined KYC processes include all activities necessary to confirm the authenticity of their clients and evaluate and track risks.

These techniques aid in identifying and preventing terrorism funding, money laundering, and other illicit corruption activities. The KYC procedure includes face verification, ID card verification, document verification entailing utility bills as proof of domicile, and biometric verification.

Banks must conform to KYC and anti-money laundering requirements to prevent fraud. The responsibility for KYC compliance falls on the banks. In the case of non-compliance, substantial fines may be applied.

In the United States, the Middle East, Europe, and Asia-Pacific, non-compliance with KYC, AML, and sanctions have resulted in a total of USD 26 billion in fines over the previous ten years (2008-2018) - not to mention the irreparable reputational damage.*

Different Types of Documents for KYC ID Verification

Identity verification is required before opening an account. The bank should request the following:

- Name

- Address

- Date of birth

There is no universally accepted list of OVDs (Officially Valid Documents) that can be used for KYC across all governments and regulators. There are, however, three broad categories of KYC documents:

- Identity Proof: Passport, National ID Card, Driver’s License, Voter Card, Aadhaar, Employee ID Card, PAN card, State or Central government ID, University or education ID card, Letter from a recognized public authority or servant, Banking book with photo ID

- Income Proof: Income tax returns, pay slips, bank statements

- Address Proof: Driver’s license, Passport, Voter Card, Aadhaar, Electricity bill, Credit card statement, Bank account statement, House purchase deed, Employer’s certificate for residence, Rental or lease agreement

Once this data has been submitted, the consumer must provide the bank with a government-issued identity document that verifies the data provided. The financial institution can then use this document to confirm the information contained inside it by consulting external databases.

In addition, the current KYC guideline mandates that financial institutions request a photo (selfie) from each customer. The bank can then use biometric authentication methods to ensure that the customer giving the information is the owner of the identity claimed.

Manual KYC ID Verification vs. Digital KYC Verification

A manual review of every client’s documents increases operational expenses (due to more time spent on training and onboarding). It severely affects the customer experience by adding unnecessary complexity to the onboarding process. While it becomes crucial for some complex and high-risk cases, manual verification is inefficient for all customers. Not to mention, a single error could lead to detrimental consequences.

Using a digital KYC verification solution is essential for establishing an efficient risk-based strategy for identifying and confirming the digital identity underlying a transaction, for both new and current clients, instead of relying exclusively on manual inspection, which is inefficient. A risk-based strategy will examine a customer’s risk profile and assess if extra verification of high-risk customers or use cases is required.

Dynamsoft for Effective Digital KYC Verification

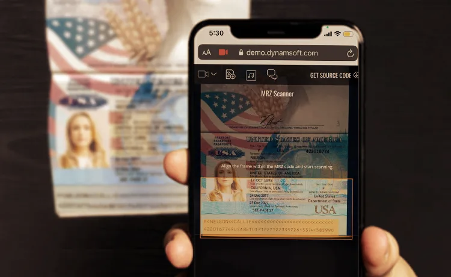

When it comes to KYC processes, customer identity is the most critical factor when ID verification is needed. Dynamsoft’s ID scanning SDKs use barcode recognition and MRZ scanning technologies to quickly identify customer IDs, such as driver’s licenses, Aadhaar cards, PAN cards, passports, etc. for effective KYC identity verification.

ID Scanners from Dynamsoft are ideally suited to the rigorous requirements of KYC document verification in banking, where precise and reliable ID verification reading is paramount. Quickly and accurately verify, authenticate, and collect data from identity documents with the help of Dynamsoft’s barcode reading and MRZ scanning SDKs.

-

High-Performance MRZ Scanning: Perform KYC passport verification with Dynamsoft MRZ Scanner SDK. Build a robust ID scanning solution to capture and extract user’s information from the machine-readable zone on passports at different angles with near 100% accuracy. Scan national Identity Cards with a machine-readable zone at an outstanding speed with brilliant accuracy.

-

Robust Barcode Reading: Extract information from PDF417 codes on driver’s licenses, QR codes on Aadhaar Cards, and dense QR codes on PAN Cards even without an internet connection. Proprietary technology lets you fetch data from almost every ID document in the world, including IDs with micro PDF417 barcodes, extremely dense QR Codes, etc.

-

Seamless Deployment on Web and Mobile Devices: With just a few lines of code, you can quickly secure and implement the module with regular software maintenance. Embed barcode reading and MRZ scanning capability on web, desktop, and mobile devices.

-

Global Compliance: The safest, most powerful ID scanning software trained to scan and extract data from IDs. The processing is done entirely on-device with GDPR in mind; no internet or server connection is needed. In other words, sensitive information never leaves your app.

Try Dynamsoft SDKs for Digital KYC Verification

With Dynamsoft’s top-grade barcode reading and MRZ scanner SDKs, you can quickly verify identity documents anywhere, anytime for automated KYC document verification. You can easily integrate enterprise-grade ID scanning into web or mobile apps using a few lines of code. Select from hundreds of APIs to capture and parse data accurately to suit your unique use cases.

Contact us today to learn more about our ID scanning offerings.

Try the Dynamsoft MRZ Scanner SDK Online Demo.

Check out the Dynamsoft Barcode Reader SDK Demo.

*Source: IMF.org

Blog

Blog